The Essential Guide to Forex Trading Platforms

In the fast-paced world of currency trading, selecting the right forex trading platform Forex Brokers in Indonesia can make a significant difference. A robust trading platform serves as the primary interface for traders, providing the tools and resources necessary for executing trades effectively. This article will delve into the various aspects of Forex trading platforms, detailing what to look for and the benefits they offer to both novice and experienced traders.

Understanding Forex Trading Platforms

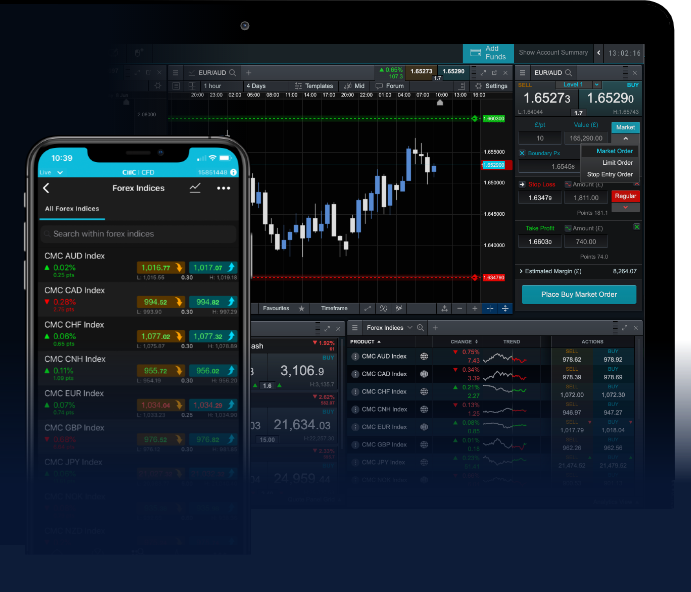

A Forex trading platform is software that enables traders to buy and sell currencies, manage their accounts, and conduct market analysis. These platforms come in various forms, including desktop applications, web-based platforms, and mobile applications. Each type offers distinct advantages, catering to different trading styles and preferences.

Types of Forex Trading Platforms

Understanding the types of platforms available is crucial for making informed decisions. The primary categories include:

- Desktop Platforms: These are dedicated applications installed on a user’s computer. They usually offer comprehensive features, advanced charting options, and enhanced performance. Popular examples include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Web-based Platforms: Accessible through any web browser, these platforms provide flexibility without the need for downloads. They are ideal for traders who frequently change devices or wish to trade on the go.

- Mobile Trading Apps: With the rise of smartphone usage, mobile trading apps have gained popularity. They allow traders to access their accounts, execute trades, and monitor the market anytime and anywhere.

Key Features of Forex Trading Platforms

When evaluating Forex trading platforms, several essential features should be considered:

1. User Interface and Usability

A clear, user-friendly interface allows traders to navigate the platform easily, making it simple to execute trades and access market data. Platforms should prioritize usability for both experienced traders and beginners.

2. Charting Tools and Technical Analysis

Advanced charting capabilities are vital for conducting technical analysis. Traders benefit from features such as customizable charts, indicators, and drawing tools, which help in making informed trading decisions.

3. Market Access

The ability to access a wide range of currency pairs and other financial instruments is crucial. A good trading platform should provide diverse market access, including major, minor, and exotic currency pairs.

4. Trade Execution Speed

In Forex trading, timing is everything. The platform should enable quick order execution, minimizing slippage and ensuring that trades are executed at the desired price. This is especially important during volatile market conditions.

5. Security Features

Security is a top priority in Forex trading. The platform should employ industry-standard security measures, including encryption protocols and two-factor authentication, to protect users’ information and funds.

6. Customer Support

Reliable customer support is essential, especially for new traders who may require assistance. Look for platforms that offer multiple support channels, such as live chat, email, and phone support.

How to Choose the Right Forex Trading Platform

Choosing the right platform involves several considerations:

1. Assess Your Trading Style

Different platforms cater to various trading styles. For instance, day traders may prefer platforms that offer advanced charting and analytical tools, while long-term investors might prioritize a platform with excellent research and fundamental analysis resources.

2. Compare Fees and Commissions

Different platforms have varying fee structures, including spreads, commissions, and withdrawal fees. It’s wise to compare these costs, as they can significantly impact overall profitability.

3. Read Reviews and Testimonials

Before settling on a platform, research user reviews and testimonials. These can provide insights into the platform’s reliability, performance, and customer service.

4. Consider Regulatory Compliance

Ensure that the trading platform is regulated by a reputable authority. This adds an additional layer of security and trustworthiness to your trading experience.

The Future of Forex Trading Platforms

As technology continues to evolve, so do Forex trading platforms. Trends such as algorithmic trading, artificial intelligence (AI), and machine learning are increasingly being integrated into trading systems, providing traders with more sophisticated tools and insights. Additionally, the rise of cryptocurrencies is prompting many platforms to expand their offerings to include digital assets, further enhancing opportunities for traders.

Conclusion

Choosing the right Forex trading platform is a critical step for anyone looking to participate in the foreign exchange market. By understanding the types of platforms available, the key features to consider, and how to make an informed choice, traders can maximize their potential for success. As the market continues to develop, staying informed about trends and innovations in trading technology will ensure traders are well-equipped to navigate the complexities of Forex trading.